free crypto tax calculator reddit 2020

CryptoTraderTax is the easiest and most intuitive crypto tax calculating software. Support for many exchanges.

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Since then its developers have been creating native apps for mobile devices and other upgrades.

. Koinly can generate the right crypto tax reports for you. Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to cryptocurrency tax too. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains.

As soon you trade it for currency controlled by a government its. Easily print tax reports at any time. Easy import from nearly any crypto exchange.

Connect 4500 coins form all exchanges and wallets. Laura has had over 200 clients come to her for cryptocurrency tax filings including individuals small business owners C-suite level business executives expats students high and low-income earners and others. Straightforward UI which you get your crypto taxes done in seconds at no cost.

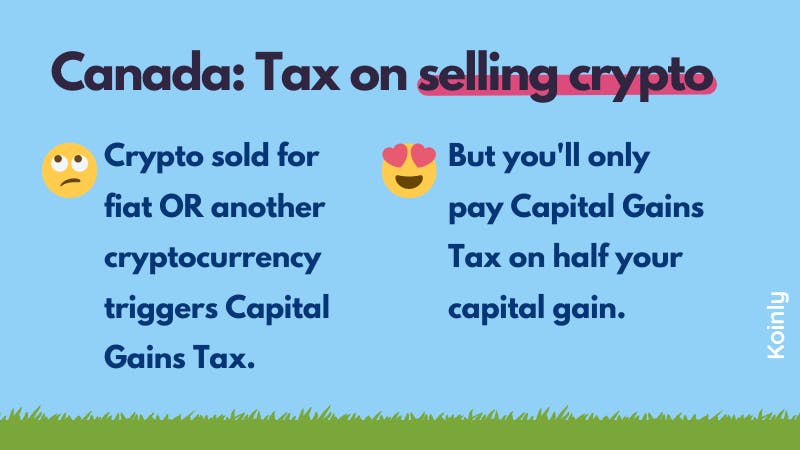

Poof out of their reach if you just keep your cool. Help Reddit coins Reddit premium. But remember - youll only pay tax on half your capital gain.

The process is the same just upload your transaction history from these years and we can handle the rest. Depending on your tax bracket for ordinary income tax purposes long-term capital gains which are recognized when an asset is held for at least one year one day are taxed at a rate of 0 15 or 20. Our subscription pricing is per year not tax year so with an annual subscription you can calculate your crypto taxes as far back as 2013.

Cryptotradertax is one of the best online cryptocurrency tax calculator. Do I have to pay for every financial year. As Tim Brunette co-founder of Crypto Tax Calculator.

It handles multiple coinsexchanges and computes longshort-term capital gains cost bases inout lot relationships and account balancesIt supports FIFO and LIFO and it generates output in form 8949 format so that tax accountants can understand it even without being. Zen Ledgers Bitcoin Crypto Tax Calculator. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate.

The 1 feature I care about in a crypto tax software is does it support an accounting method that saves me the most tax money by minimizing. We are excited to announce new pricing that enables beginner cryptocurrency users to automatically calculate their taxes for free. If you are filing in the US Koinly can generate filled-in IRS tax forms.

Then I released it on Reddit for free. Crypto tax software and cointracking calculator. Simplified somewhat crypto tax calculation method.

100 - 200 comment karma. Tax-Loss Harvesting With A Crypto Tax Calculator. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

How much tax you pay will depend on how long you hold your Bitcoin. Supports USA UK Austria Germany and Switzerland. If not look elsewhere.

I had a play with the free plan for my crypto dabblings. Calculate and report your crypto tax for free now. Where and how taxes are collected from crypto-investors and companies and what part of a profit from investments in crypto assets has to be given to the state in 2020 today were about to find out.

Seems to work well. Starting today cryptocurrency users with up to 25 transactions in a given tax year can use CoinTracker to calculate cryptocurrency taxes free of charge. Ad Helping You Avoid Confusion This Tax Season.

1 - 2 years account age. As long your crypto is in your own wallet. Download your tax documents.

Support for all exchanges and 10000 cryptocurrencies. You will only start to pay Income Tax when your hit 18200 in total income per year. Stock market in 2020.

CryptoTraderTax is the fastest and easiest crypto tax calculator. CoinTrackinginfo - the most popular crypto tax calculator. Top posts august 30th.

Form 8949 Schedule D. Level 2 1 yr. I have not done my crypto taxes since 2017.

Join over 100000 crypto investors calculating their profits losses and tax liabilities today. I wrote RP2 the privacy-focused free open-source US cryptocurrency tax calculator up to date for 2021. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

The Crypto Tax Girl website also offers free tax tips while Lauras YouTube page has more crypto tax explanation videos. Jan 21 2020 2 MIN READ. Since cryptocurrencies are part of a new industry the practice of tax collection on their turnover is at the initial stage.

You can see the Federal Income Tax rates for the 2021 and 2022 tax years below. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Cryptocurrency Tax Calculator.

Try Our Free Tax Refund Calculator Today. Can export US and Canadian tax forms. Can be uploaded to TurboTax.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Whether you are filing yourself using a tax software like TurboTax or working with an accountant. You can still buy things with crypto and even more in the future.

Crypto taxpayers can use the libra tax calculator for free for up to 500 transactions while the paid subscription allows them to track 5000. And while were at it in countries where a certain amount of personal use is tolerated as a tax-free activity crypto spent on food coffee and personal gadgets may be deducted first. The original software debuted in 2014.

It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of cryptocurrency use cases whether you are mining staking lending or simply buying or trading CryptoTraderTax will automate your tax reporting. I have come across crypto tax software tools like CryptoTraderTax BitcoinTax and some other ones which actually appear to be very slick but I feel a bit hesitant to give quasi-unknown companies full read access to my wallet addresses portfolio amount personal email address etc. You are your own bank offshore.

Income 2021 Income 2022 15.

Cara Melakukan Request Ph Mmm Prizm

How To Calculate Crypto Taxes Koinly

Blockfi Vs Celsius Network What S The Better Crypto Interest Account

The Ultimate Australia Crypto Tax Guide 2022 Koinly

Serious How Are You Dealing With Crypto Tax In 2020 2021 R Cryptocurrency

Cryptocurrency Taxes In Australia The 2020 Guide R Bitcoinaus

Bitbuy S 2020 Canadian Crypto Tax Guide R Bitcoinca

The Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Calculate Crypto Taxes Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Germany Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

How To Calculate Crypto Taxes Koinly

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Personalfinancecanada

Us Crypto Tax Software Options Your Preference Experience R Cryptocurrency